Public Expenditure on Old-Age Income Support in India: Largesse for a Few, Illusory for Most#

MUKESH ANAND, Associate Professor, National Institute of Public Finance and Policy, New Delhi, India. email:mukesh.anand@nipfp.org.in

RAHUL CHAKRABORTY, Project Associate, NIPFP. email:rahul.chakraborty@nipfp.org.in

|

Extant studies deciphering public expenditure on old-age income support in India carry limitations on (a) system expanse, (b) corresponding data collation, and therefore (c) depth of resource conscription. Benchmarking to the five-pillar architecture advanced by World Bank for old-age income support system, we trace (a) elderly covered, (b) public expenditure, (c) workers included, and (d) average benefits, for the year 2013-4 under each pillar in India. The program constituents for respective pillars in India are heuristically identified. Box 1 enlists the different schemes or components for each pillar featuring in the 5-pillar architecture.

Box 1. Income Support System for Elderly in India

Pillar-0: Social (Poverty Alleviation) Programs

• National Social Assistance Programme (NSAP)

Pillar-1: Public-service programs

• Freedom Fighters’ Pension Scheme (FFP)

• Defined benefit (DB) plan for defence personnel

• DB plan for Fed. Gov. civilian employees in service before

January 01, 2004.

• DB plan for sub-national Gov. employees in service prior

to their respective ascension to National Pension Scheme

(NPS).

Pillar-2: Mandatory, Co-contributory (Employer –

Employee) programs

• NPS for Civilian employees joining Fed. Gov. on or after

January 01, 2004

• NPS for sub-national Gov. employees joining on or after the

date of respective ascension to NPS

• Schemes operating as hybrid Defined contribution (DC)-DB

plans include,

(a) Coal Mines Provident Fund Scheme (CMPFS), 1948

(b) Employees Provident Fund Scheme (EPFS), 1952

(c) Assam Tea Plantations Provident Fund

Scheme (ATPFS), 1955

(d) Jammu and Kashmir Employees Provident Fund,

1961, and

(e) Seamen’s Provident Fund, 1966

Pillar-3: Personal (voluntary) plans

• General Provident Fund: public sector employees

• NPS-Private – open to all citizens

• Atal Pension Yojana

• Public Provident Fund: Open to all citizens

• Senior Citizen Savings Scheme

Pillar-4: Intra-family and In-kind transfers

• Annapurna Scheme: part of NSAP

• Integrated Programme for Older Persons (IPOP)

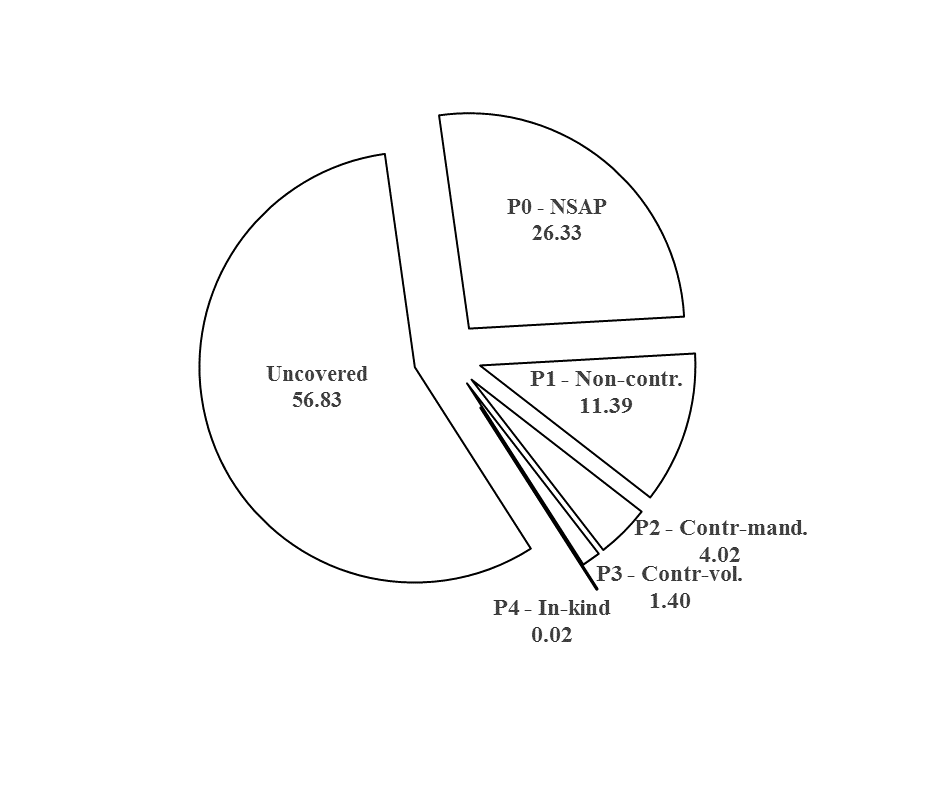

The number of elderly covered under each pillar are estimated using data drawn from diverse sources on identifiable groups. Figure 1 shows that only 43 percent of 118.36 million elderly benefitted from related public expenditure.

Figure 1. Distribution of Elderly Population by Source Program of Income Support, percent, 2013-4

For the federal, and each sub-national government, public expenditure that eventually translates into periodic and terminal benefits for elderly, includes, (a) solatium in social assistance programs, (b) deferred compensation in non-contributory programs, (c) incentivizing contribution for workers participating in voluntary programs, (d) co-contribution for employees included in mandatory programs, and (e) interest payments towards investment of funds from contributory (mandatory and voluntary) programs in government bonds and securities. In 2013-4 the elderly comprised 8.6 percent of the population, and old-age income support system entailed 11.5 percent of public expenditure of combined federal and sub-national governments. The sub-national governments bear a larger (60 percent) share, which is rising and carries implications for macroeconomic balance.

|

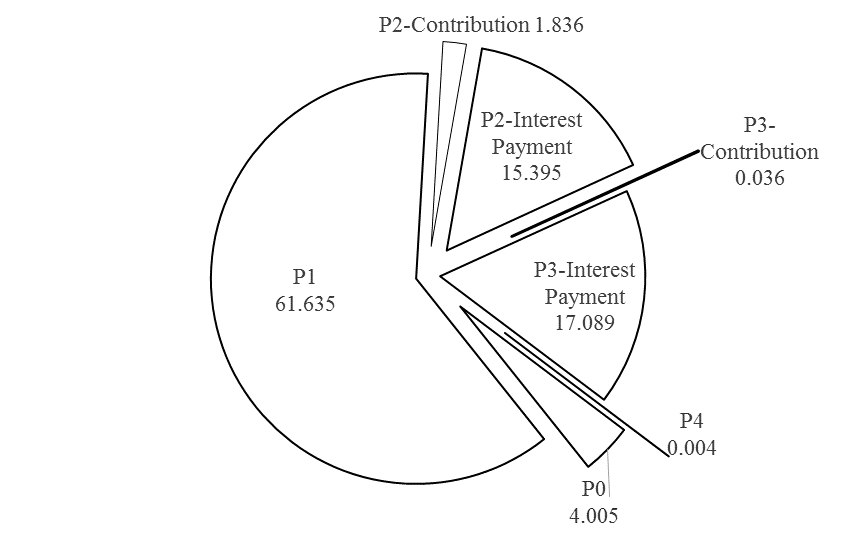

Figure 2. Distribution of Public Expenditure on Old-age Income Support, 2013-4, percent

Notes: P0, P1... relate to respective pillar-0, pillar-1… as shown in figure 1; Authors’ computation.

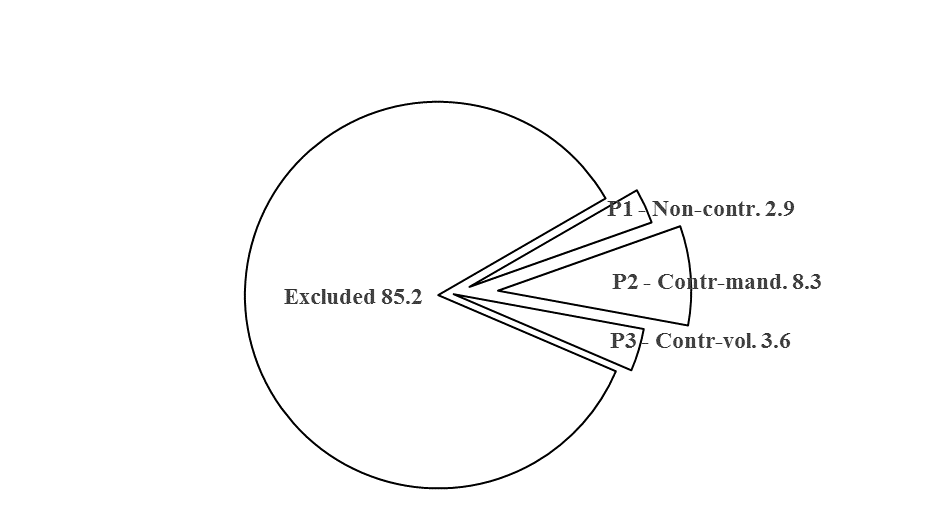

Figure 2 shows that less than two percent of it constituted co-contributions in the nature of capital expenditure, while figure 3 shows that more than 85 percent workers remain excluded from the system.

Figure 3. Distribution of Workers by Membership with Programs, percent

Notes: Worker population from census; Membership with mandatory schemes from respective annual reports - that pertain to differing, but proximate, years – We assume membership to be not significantly different in 2013-4

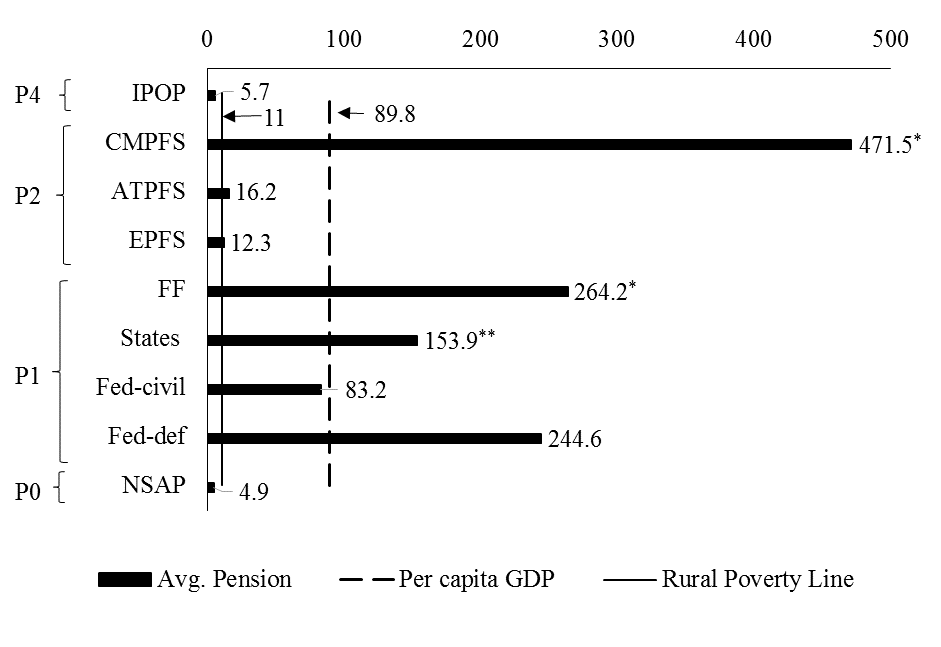

Government ex-workers drawing defined benefit cornered almost 62 percent of system expense (cf. value for P1, Figure 2), and constitute only 11.4 percent of the elderly, while, 70 percent of all beneficiaries including those drawing social pensions collect less than the rural poverty line (INR 11016 per annum). Figure 4 depicts the average annual pension benefit drawn by broad identifiable groups of beneficiaries.

Figure 4. Average Annual Pension Benefit by Beneficiary Groups, 2013-4 (’000 INRs)

Notes: Authors’ computation; *: Relates to 2014-5; **:

Relates to 2011-2.

Continuing with the extant system dimensions could strain the social fabric. The repertoire of actions, preferably in that order, must first, rework on the DB component of the architecture by (i) rationalising ‘eligible pay’ to represent work-life contribution, and (ii) weaning it completely off wage indexation. Second, reform regulation paradigm to encourage ‘inclusive’ mandatory programs by (i) harmonizing rules across multiple regulators and eventually (ii) dissolving regulatory distinction based on sector, region, scale, and number of workers in organization. Third, signal state commitment to protect low-earning workers’ by (i) unrequited financial contribution against work-force participation, and further (ii) incentivizing financial thrift. And last, utilize IT-enabled interface for citizens’-identifier and banking for efficient program delivery.

#: Based on, NIPFP, Working Paper No. 253, February, 2019.

|