I read Dr. Lekha S. Chakraborty's book titled "Fiscal Consolidation, Budget Deficits and the Macro Economy" with interest. It is a book of substance. In less than 200 pages, the author has tried to pack consideration of many contentious issues relating to fiscal policy and its linkages with overall macro economic performance. The book is ambitious in its scope, aiming to fill the gap in the existing literature on the fiscal monetary policy linkages and the impact on macro-economic outcomes. The author tries to substantiate her observations with technical analysis of relevant data. The tools of analysis and the data utilised are impressive.

Candid that the narration is, the Preface itself recognises the limitations of data for analysis. Firstly, public sector borrowing is more relevant than fiscal deficit for macro-economic analysis but that could not be used in the analysis in the book due to non-availability of information. Secondly, the state government borrowings are also not included. Thirdly, it is not only the levels of deficit but also the financing pattern of deficits and the purpose for which the borrowings are utilised but analysis does not have access to appropriate data. Subject to these limitations, one conclusion is that supply side factors exert inflationary pressures in Indian economy more than deficit per se.

The brief introduction provides an outstanding and precise account of the concept of fiscal deficit, the measurement issues, and the alternate paradigms relating to macroeconomic effects of fiscal deficit. The stated theoretical framework is that the macro economic impact of fiscal deficit depends on how it is financed, namely, seigniorage or debt.

The second chapter is commendable for drawing attention to the fiscal deficit of sub-national governments and its implications for macro-economic management.

Chapter 3 seeks to analyse, perhaps, the most contentious subject, namely the crowding out effects of fiscal deficit as distinct from crowding in. Even more complex is the interest rate determination in a world where the fiscal deficits and financial markets interact to determine the interest rates. This leads the author to highlight the monetary fiscal policy coordination, essentially in terms of monetary seigniorage. The conclusion of the Chapter is unexceptionable, namely, 'money does cause inflation in India, although not an exclusive role.' (page 162)

Highly informative account and in-depth analysis in the nine-chapter book provokes questions that could be subjects for further research. Firstly, the supply side factors are no doubt important, but the most important supply side factors relevant to inflation relate to oil prices and food prices. The impact of both these on inflation, are moderated by use of fiscal instruments, viz., the taxes and the subsidies. How much of the supply side factors are captured fully in the inflation data? Fiscal measures, and not merely supply side, impact prices of these two important factors in headline inflation.

Secondly, is there a role for financial markets and rating agencies in assessing the fiscal sustainability and the fiscal deficit as well as the determination of interest?

Thirdly, to what extent the financial repression, specially the high statutory pre-emptions, suppresses the adverse impact of the fiscal deficits on inflation? Irrespective of the actual holdings of the Government security by the banking sector, the statutory stipulation by itself operates as financial repression.

The major conclusion in the book on the basis of analysis is that recently adopted macro policy framework in India built on fiscal rules and inflation targeting, could potentially have adverse long run consequences for economic growth.

With recent abandoning of inflation targeting by New Zealand, the originator of inflation targeting in 1989, the author may find endorsement of her conclusion more now, than ever before.

A contribution of the book is in its assertion that monetary policy and fiscal policy cannot be considered in isolation, and that both should be considered in an integrated manner. This is particularly true of countries which are attempting structural transformation like India. It is equally true for advanced economies in meeting crisis situations.

The author should be complimented for a timely value addition to the growing literature on the importance of fiscal monetary policy interface. The book should be of interest to students, academics, policy makers, and media.

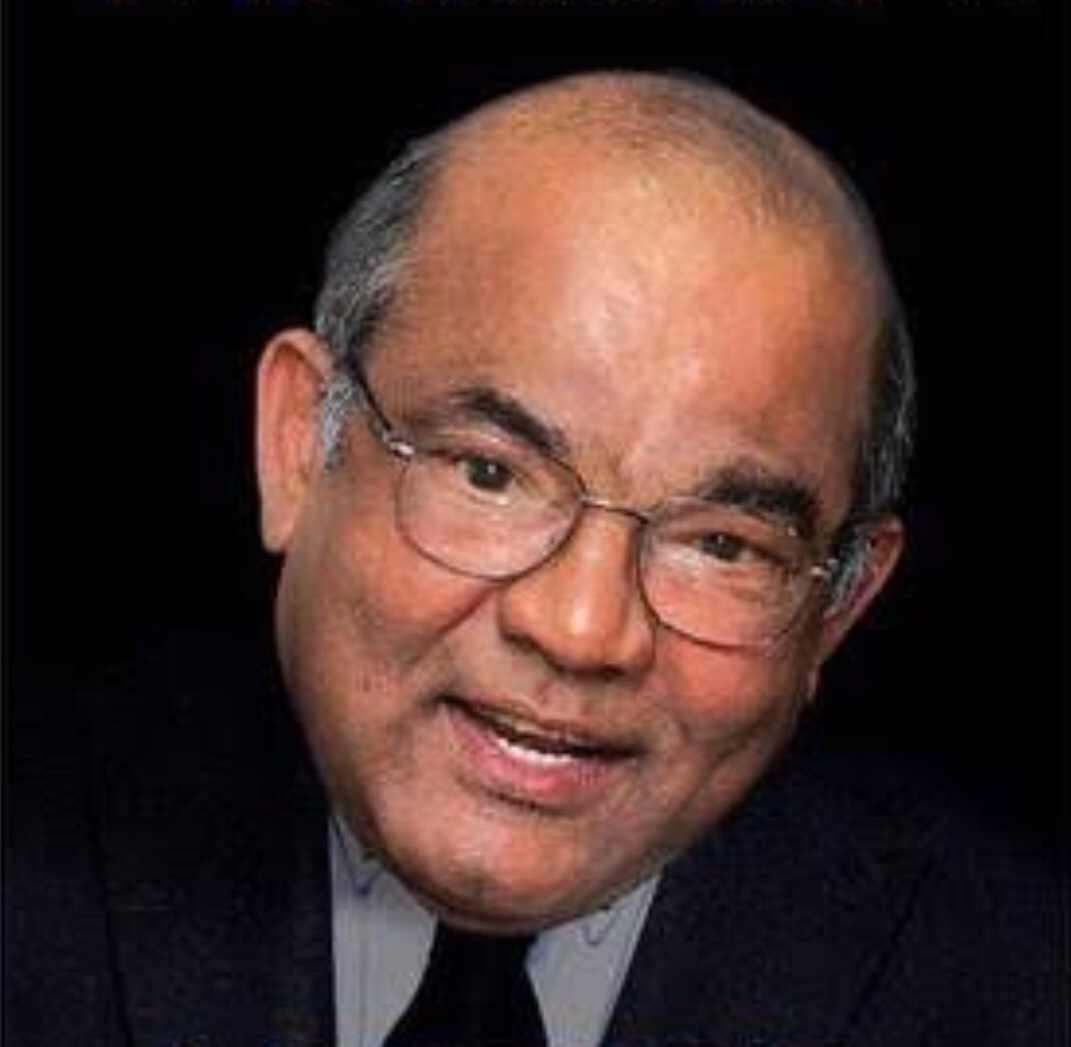

The author is Yaga Venugopal Reddy, better known as Y.V. Reddy, the 21st Governor of the Reserve bank of India from 2003-2008 and the Chairman of the Fourteenth Finance Commission of India from 1st Feb. 2013 to 31st December 2014. Detailed Bio

The views expressed in the post are those of the author only. No responsibility for them should be attributed to NIPFP.