In contemporary federalism, fiscal behaviour of States has not been predominantly determined by the patterns of intergovernmental fiscal transfers. The recent central government policies and reforms in India are also influencing debt-deficit dynamics at the subnational level. With the introduction of UDAY1, this dimension has reached an added significance for state-level debt and deficits including the issue of measurement of deficits.

The following three policy articulations need to be simultaneously analysed here to capture the plausible impact of UDAY on the subnational public finance and measurement issues in judging fiscal prudence.

1. The Fourteenth Finance Commission (FC-XIV) recommended that the fiscal deficit of all states will be anchored to an annual limit of 3 per cent of GSDP for the award period (2015-16 to 2019-20), however, relaxations were given to state governments for additional borrowings provided they met some criteria of fiscal prudence.2 This policy framework became operational from April 2016.

2. The UDAY scheme envisaged that 75 percent of the outstanding debt of the DISCOMs (power distribution companies) as on September 30, 2015 would be taken over by the State Governments. The scheme also provided for the remaining 25 percent of the debt to be re-priced or issued as State guaranteed DISCOM bonds, at coupon rates around 3% less than the cut-off yield rate of G-Sec announced by RBI on that day. This debt restructuring aimed at interest savings for DISCOMs through reduction of debt and also through reduced interest rates on the remaining debt. The enhanced fiscal deficit of the State due to the effect of UDAY may be adjusted from State’s eligibility of FRBM rules.

3. The FRBM review committee report 2017 recommended a transition in the fiscal rules from deficits to debt, with a cap on debt-GSDP ratio at 60 percent, with 40 percent at the Centre and 20 percent at the States, unless an “escape clause” can be invoked due to any “exceptional circumstances” including unanticipated fiscal implications of structural policies and natural calamities.3

However, the FRBM review committee suggested that the horizontal rules of the subnational debt cap needs further articulation and strengthening by the Fifteenth Finance Commission. Keeping these policies in mind, let us try to understand the implications of UDAY on subnational public finances. The RBI in its State Finance Report-2016-17 has given data for fiscal deficit with and without UDAY for the year 2016-17 (RE) at 3.4 per cent (with UDAY) and 2.7 per cent (without UDAY) of GSDP (RBI 2017, page 13) respectively. However, the analysis of Memorandum of Understandings (MOUs) signed as tripartite agreement between the Government of India, DISCOMs and the State Governments gives a prima facie understanding of likely impact of UDAY on States’ debt and thereby on the fisc.

The Efficiency Parameters of UDAY

The aim of UDAY is financial turnaround and revival of DISCOMs. But the irony is that, in India, in spite of having surplus power generation, electricity is not distributed to the industrial and household customers due to huge debt liabilities of DISCOMs. Therefore, UDAY aimed to set free DISCOMs of excessive debt through (i) improving operational efficiencies of DISCOMs; (ii) reduction of cost of power; (iii) reduction in interest cost of DISCOMs; and (iv) enforcing financial discipline on DISCOMs through alignment with state finances.

The UDAY has been optional for all states; however, states were encouraged to be a part of the scheme and benefit from the same. This was against the backdrop of accumulated loss of 3.8 lakh crores and outstanding debt of 4.3 lakh crores over the years by the Power Distribution Companies (DISCOMs) as on March 2015. One of the reasons for the increase in the debt was lack of upward revisions in tariffs commensurate with the increase in cost of power supply. Inadequate subsidy receipt and no improvement in efficiency level were also other reasons for enormous increase in power sector debt.

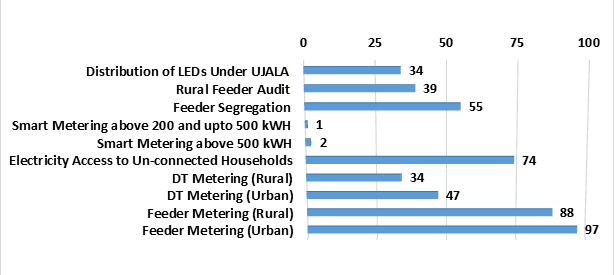

Four financial parameters are given in UDAY portal of Government of India. These are i) Aggregate Technical and Commercial Losses (AT&C losses), ii) ACS-ARR gap, iii) UDAY bonds issued and iv) the list of states with tariff revisions. The progress in operational efficiency parameters of UDAY are given in Figure 1.4 Except for feeder metering, the other efficiency indicators are still not satisfactory. While AT&C losses is still 19.68 per cent in India, the AS-ARR gap is noted to be INR 0.49 per unit. As per the portal, out of 27 UDAY states, all states except Tamil Nadu and Rajasthan have issued notifications for upward tariff revisions. The total bonds issued is 86.5 per cent.5

Figure 1: Progress of UDAY Operational Efficiency Parameters, India (in %)

Source: UDAY Portal, Government of India

Impact of UDAY debt on State Finances

Given the limited progress in UDAY efficiency parameters, it is pertinent to ask about the likely impact and future implications of the UDAY debt on state finances. To arrive at an aggregate debt (with and without UDAY) is a challenge. As all states have not provided UDAY-disaggregated debt figures in their recent budgets, we cannot provide an aggregate number. The RBI State Finances Study for the year 2016-17 has also provided the fiscal deficit number but not the aggregate debt with and without UDAY. However, in all likelihood, there will be asymmetric impact of UDAY across states since power sector debt liabilities are different across states. For instance, the Budget 2017-18 of Rajasthan revealed that the fiscal deficit with UDAY as percent of GSDP was as high as 9.38 per cent in 2015-16 due to the absorption of 50 percent of DISCOM debt in that year (which was INR 62,000 crores). The outstanding liabilities exploded to 33.79 per cent in 2016-17 (RE) which was much above the FC-XIV suggested debt cap of 25 per cent of GSDP or the proposed target of 20 per cent recommended by FRBM review committee to be achieved by 2025.

The UDAY-incorporated forecast path of outstanding liabilities of States would depend on a host of factors including the buoyancy of state revenues and performance of DISCOMs. This raises a fundamental question. What should be the criteria to judge fiscal prudence at the state level? May be it is time to propose that future reforms on debt and deficit should judge fiscal prudence based on comparable measures of deficits and debt across States. The aim should be to have a comprehensive measure of Public Sector Borrowing Requirement (PSBR) by encompassing all public sector liabilities at the State level including power sector debt, than using a measure which only reflects deficit arising out of budgetary transactions.

1 UDAY is the Ujwal DISCOM Assurance Yojana (UDAY) scheme announced by Minister of State (IC) for Power, Coal & New and Renewable Energy in November 2015. We will revisit its details later.

2 Box II.1 (page 11), RBI State Finance Report, 2016-17.

3 For details on ‘escape clause’, refer Chapter 8, FRBM Committee Report, 2017 (Volume 1), pages 127-130.

4 These operational efficiency improvements are likely to bring down the gap between average revenue realized (ARR) and average cost of supply (ACS) from 22% to 15% by 2018-19.

5 UDAY Bonds Issued : INR 232500 Crore (86.5%) and UDAY Bonds to be Issued : INR 268778.21 Crore. This does not include data of Goa, Karnataka, Gujarat, Uttarakhand, Manipur, Puducherry, Sikkim, Kerala, Tripura, Arunachal Pradesh and Mizoram.

The author is Associate Professor, NIPFP. Click here for detailed profile.

The views expressed in the post are those of the author only. No responsibility for them should be attributed to NIPFP.