Implications for demand growth & sectoral inflation

Following the announcement by Prime Minister Narendra Modi, Indian currencies with denomination 500 and 1000 have ceased to be the medium of exchange from the midnight of 8th November, 2016. This demonetisation move is implemented as a tool to measure the stock of black money hoarded in these high denomination currencies, and to curb terrorist activities in the country. The government aims to bring the unaccounted money back to the formal banking sector by allowing limited exchange and unlimited deposit of old notes in bank accounts till 30th December, 2016. The goal is to replace these old currencies with new high value currencies and currencies with lower denomination.

Since the announcement, the country is flooded with reports on incidents of long queues in front of banks and ATM machines, and mass failure to exchange and withdraw money. The demonetisation move has inflicted an unexpected negative liquidity shock on the economy, extracting out the money stock that constituted 86% of the currency in circulation and roughly 11% of the broad money. The shock is expected to persist beyond 30th December, given the low level of financial deepening in the economy. With a large informal sector having majority of transactions in cash due to lack of access to financial services, this liquidity crunch is expected to hit the consumption demand most. This note attempts to trace out in the backdrop of incomplete financial inclusion, under certain simplified assumptions, the extent of liquidity shock in the current quarter, and its impact on growth and sectoral inflation via demand channel for the next few quarters ahead.

As on 2014, compared to advanced economies, where 96% of the population above 15 years of age holds account at a financial institution, only 53% of the same age group have an account at a financial institution in India (See Table 1). The number of commercial bank branches catering per 100,000 population in advanced economies is 3 times higher than in India. The number of ATMs available to per 100,000 population is more than 11 times higher in advanced economies and 8 times higher in other emerging economies than in India. While 22% of the population above age 15 holds debit card in India, the corresponding number for emerging economies and advanced economies are 49% and 84% respectively.

Table 1: Degree of financial inclusion in India vis-a-vis other emerging and advanced economies (some selected indicators)

|

Indicators of financial inclusion

As of 2014

|

Advanced economies |

Emerging economies |

India |

|

Account at a financial institution (% age 15+) |

95.85 |

67.88 |

52.75 |

|

Commercial bank branches

(per 100,000 adults)

|

33.57 |

19.41 |

11.38 |

|

Automated teller machines

(per 100,000 adults)

|

136.45 |

86.38 |

11.21 |

|

Debit card (% age 15+) |

84.50 |

49.48 |

22.07 |

Source: World Bank

In an attempt towards financial inclusion, government launched Jan Dhan Yojana in August 28, 2014. The purpose of the scheme was to open zero balance saving account for every unbanked Indian household, providing access to financial literacy, credit and pension. Under the scheme, as on 28.10.2015, 19.02 crore accounts have been opened, out of which 11.58 crore accounts are in rural areas and 7.44 crore in urban areas. While some of the accounts are opened for already existing customers, in majority of cases, opening of account has been restricted to only those with no bank account. Under the simplified assumption, that this additional 19 crore accounts is equivalent to 19 crore people above age of 15 years, and using the total number of population in this cohort in 2014, one can arrive at the percentage of adults having bank account in 2015, which is 73% of the adult population. Given this scenario of less than 100% financial inclusion in the economy, it is interesting to assess the impact of demonetisation on macroeconomic indicators in the next few quarters to come.

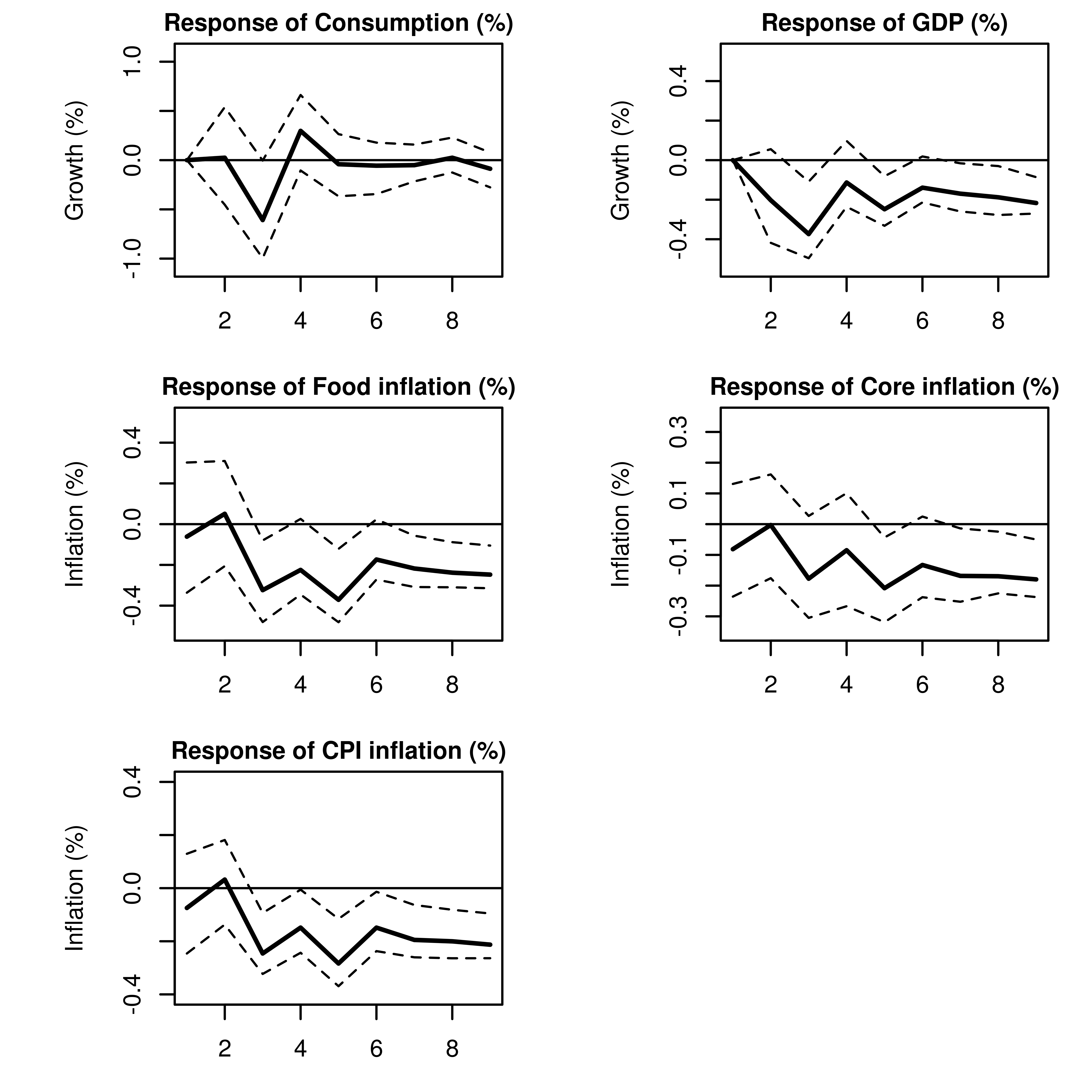

A short run analysis, taking into account the interlinkages of macroeconomic variables indicates that 1% negative shock to money growth causes a transitory reduction of real consumption growth by 0.6% after 3 quarters of the shock (See Figure 1). The real GDP growth declines by 0.37 percent after 3 quarters. The magnitude of the impact declines after that, but remains significant for the next subsequent quarters. After three quarters of the shock, food inflation declines by 0.32%, while core and headline inflation decline by 0.17% and 0.24% respectively.

Under a few simplified assumptions, ceteris paribus, M3 growth at the end of the current quarter will be -1%, implying a drop in the M3 growth rate at the end of the current quarter by 6.48% compared to the growth rate of 5.48% in the previous quarter. The assumptions are listed as follows:

Demonetisation has extracted around Rs. 14,50,000 crore from currency in circulation. This amounts to 11% of M3 at the quarter ending in September. Demonetisation reduces M3 from September ending quarter to the current quarter by 11% at the first stage.

Assume that currencies in circulation with 500 and 1000 denomination has been equally distributed across adult population and 73% of the adult population has bank account. Then 73% of the depleted money stock will be replaced back to the system by 30th December, 2016.

Assume a very optimistic environment with high level of banking efficiency, where, an additional 20% of the depleted stock will be back to the system through the exchange of old notes by people who do not have any bank account.

Following a decline in the money growth by 6.48% in the current quarter, real consumption growth is expected to have the highest impact after three quarters with a reduction by 3.8%. The real GDP growth is expected to decline by 2.39% after 3 quarters. The effect on GDP growth will dampen at the subsequent periods, although will remain significant for some time. Food inflation is expected to fall by 2.07%, followed by headline inflation (1.56%) and core inflation (1.10%) by the second quarter of 2016-17.

This analysis attempts to portray, under a few simplified assumptions, macroeconomic effects of liquidity shock following demonetisation in the next few quarters ahead. However, in the long run, the inflationary consequences may differ from the short run outcomes substantially. Cash being the main vehicle of transactions in production and supply chain in food and agricultural sector, the current liquidity crunch would end up with decline in supply of food commodities. In the non-food sector also, investments by small and medium scale producers will fall due to shortage of cash, drying up the supply line for small and medium scale sellers of non-food products. As the liquidity scenario improves and demand restores over time, the production and supply of food commodities, as well as non-food products may not respond to it immediately, inflicting an inflationary pressure in the economy. The magnitude of the effect would crucially depend on the extent and pace of the phasing out of the liquidity shock in the economy.

The author is Assistant Professor, NIPFP. Click here for detailed profile.

The views expressed in the post are those of the author. No responsibility for them should be attributed to NIPFP.