Food Inflation in India: Causes and Consequences

RUDRANI BHATTACHARYA, Associate Professor, National Institute of Public Finance and Policy, New Delhi, India. email:rudrani.bhattacharya@nipfp.org.in

ABHIJIT SEN GUPTA*, Economist, India Resident Mission, Asian Development Bank, New Delhi, India.. email:asengupta@adb.org

|

High and persistent food inflation emerged as a major concern in India, during 2006 to 2014. While food inflation averaged 9% over this period, at its peak in late 2009, it had crossed 20%. Sustained high food inflation has significant welfare implications in India, given that food comprises 45% of the consumption basket. With 21.9% of the population, or about 270 million people, living below the poverty line, already consuming food below the subsistence level, sustained high food inflation has negative consequences. Effective stabilisation of food inflation, therefore, is of utmost priority, which makes it imperative to understand its causes and consequences.

Bhattacharya and Sen-Gupta (2015), on which this One Pager is based, analyse the behaviour and determinants of food inflation in the recent past, and evaluate the extent of transmission of food inflation to non-food and aggregate inflation. The paper finds that both demand and supply factors have contributed to recent surge in food inflation.

A factor, which has often been argued as driving food inflation in India, relates to rising income and diversification of diets raising the demand for high-value food products, and thereby adding to inflationary pressures. Bhattacharya and Sen-Gupta (2015) calculate the demand-supply gap for major food commodities including, cereals, pulses, vegetables, fruits, milk, and meat and fish, and find empirical support for this hypothesis. Using National Sample Survey Organisations household consumption expenditure survey data for 2009-10, the expenditure elasticities for all these commodities are estimated. All the estimated expenditure elasticities are found to be positive, with those for milk, vegetables and fruits exceeding one, implying that 1% increase in household expenditure is associated with a more than 1% increase in their demand. Elasticity for meat and fish, although below one, is high enough to cause significant rise in their demand with rising food expenditure. In an emerging economy, with growing per capita income, high expenditure elasticities of vitamin and protein-rich commodities indicate growing demand pressure for these commodities.

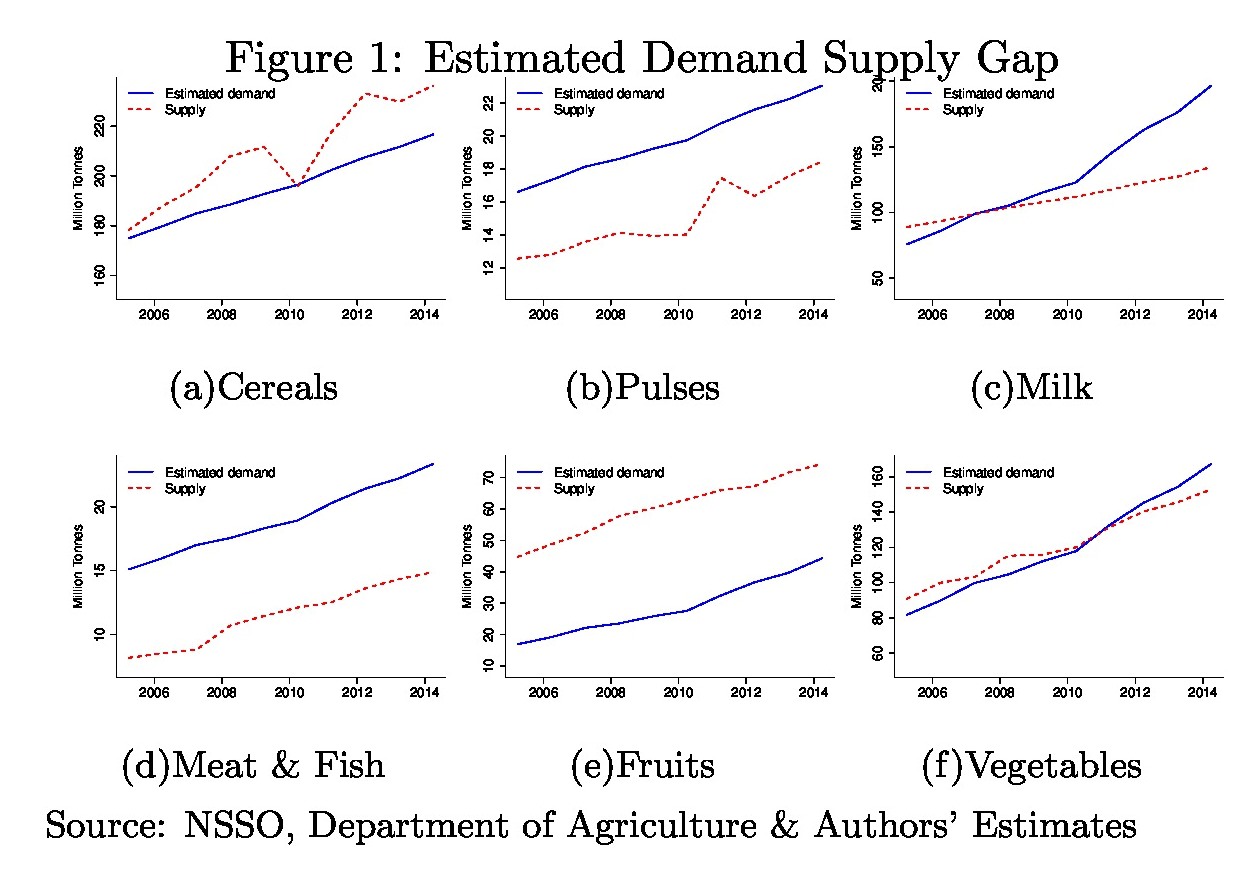

The overall aggregate demand including the indirect demand for seed feed and wastage is calculated for the period 2004-05 to 2013-14, and compared with total supply based on annual production adjusted for post-harvest wastage. Demand is found to persistently outstrip supply in the case of pulses, meat and fish, and in recent years in case of milk and vegetables (Figure 1). Overall, an additional gap of 1 million tonnes in demand relative to supply would result in food prices increasing by 0.3% to 1.1% annually.

Supply side and external factors affecting food inflation: Fuel and agricultural wage inflation and international food price surge

On the supply side, rise in prices of key inputs, including fuel and agricultural wages have impacted the prices of various commodities and aggregate food inflation. The widely hypothesised link between surge in agricultural wage growth since 2007, and the country-wide implementation of Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) in 2008, finds support in the study with a structural break being detected in 2008 for wage inflation. Given the recent deregulation of key fuel prices in India, fuel inflation can potentially affect food inflation as fuel is used for powering machines and transportation. Given rising agricultural trade integration, the surge in international food prices in 2008, and again in 2010, is another factor influencing domestic food inflation. |

To take into account the dynamic inter-linkages among food inflation, key input price inflation, demand from non-agricultural sector, and global food price inflation, a Structural Vector Autoregression (SVAR) framework, using monthly data, is estimated. The study finds agricultural wage inflation to be a universal driver of components and aggregate food inflation. Ten months after a shock, 10% of the variation in inflation in wholesale price index (WPI) for food is explained by wage inflation. The contribution of wage inflation in total food inflation doubled (21%) in the post-MGNREGA period. The study finds limited contribution of international prices, except for tradeables such as edible oil (34%) and sugar (10%), and moderate role of fuel inflation. A panel regression analysis reveals hikes in minimum support prices (MSP) have influenced inflation in rice, wheat, pulses and sugar.

A varied combination of factors is found to drive different components of food inflation. Rise in cost of production and MSP are the main drivers of cereal inflation, while inflation in milk, vegetables, and meat and fish are driven by input cost inflation and positive demand supply gap. These two factors along with MSP inflation mainly drive pulses inflation. Global food inflation increases prices of edible oil and sugar, while rise in MSP is an additional factor driving sugar price inflation.

Food inflation has a cascading effect on non-food inflation and aggregate CPI inflation

The consequences of rising food inflation for the overall inflationary scenario are estimated using a Structural Vector Error Correction model (SVECM). Ten months after a shock, food inflation explains 40% and 61% variations in non-food and aggregate CPI inflation, respectively. The transmission to non-food inflation occurs through rise in cost of labour inputs, substitution effects, and real income effect of producers in food sector (Anand et al., 2010; Aoki, 2001). Apart from direct pass-through to aggregate inflation via food’s share in the consumption basket, it also rises indirectly via rise in non-food prices.

Policy interventions:

References

Anand, Rahul, Peiris, Shanaka, and Saxegaard, Magnus (2010), “An Estimated Model with Macrofinancial Linkages for India”, Working Paper WP/10/21, International Monetary Fund.

Aoki, Kosuke (2001), “Optimal Monetary Policy Responses to Relative Price Changes”, Journal of Monetary Economics, 48, pp. 55–80.

Bhattacharya, Rudrani, and Sen-Gupta, Abhijit (2015), “Food Inflation in India: Causes and Consequences”, Working Paper 2015-151, National Institute of Public Finance and Policy.

Catao, Luis, and Chang, Roberto (2010), “World food prices and monetary policy”, Working Paper 16563, National Bureau of Economic Research.

Ganguly, Kavery, and Gulati, Ashok (2013), “The Political Economy of Food Price Policy”, UNU-WIDER.

Habermeier, Karl, Otker-Robe, Inci, Jacome, Luis, Giustiniani, Alessandro, Ishi, Kataro, vavra, David, Kisingbay, Turgut, and Vazquez, Francisco (2009), “Inflation pressure and monetary policy options in emerging and developed countries – A cross regional perspective”, Working Paper WP/09/1, International Monetary Fund. |

* The views expressed in this article are the views of the author and do not necessarily reflect the views or policies of the Asian Development Bank (ADB) or its

Board of Governors or the governments they represent.