Exchange Rate Volatility and Inflation

BISWAJIT MOHANTY, UGC Research Scholar, Department of Business Economics, Delhi University, India. email:biswajitm4@gmail.com

|

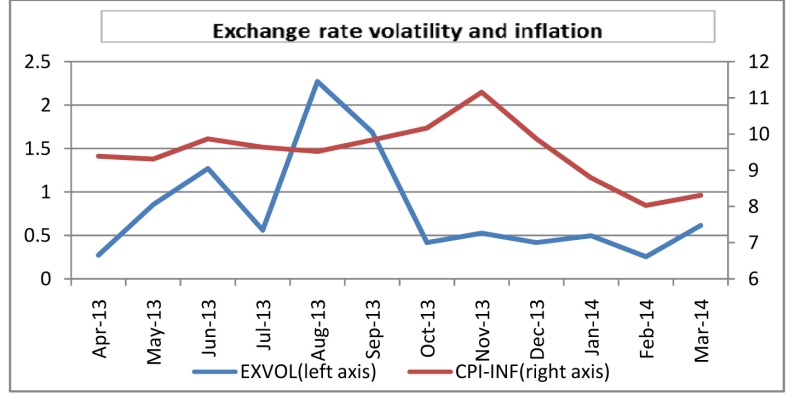

The ‘tapering talk’ in the US in May 2013 has resulted in large disturbances in the exchange rates in almost all the emerging market economies, with the exception of China. In India, the exchange rate depreciated by about 10% in nominal terms between May and June 2013. With this, the volatility in the foreign exchange market has also increased until October 2013, posing challenge to the monetary policy. What would be its impact on the other macroeconomic variables such as growth and inflation?

A look at the figure shows that in the first half of 2013-14, India experienced sharp volatility with its peak being in August 2013 when the exchange rate depreciated by 10% in just one month. Since then, with various policy measures by the central bank, there are signs of some stability in the exchange market pressure. As Summers (2000) argued, emerging economies such as India, have preference for exchange rate stability as they lack institutional requirements for undertaking effective monetary policy for maintaining price stability during sharp appreciation or depreciation episodes. This may be noted from the trends in CPI based inflation that suggest some possible causality between exchange rate volatility and inflation with some lag. Are there links between exchange rate volatility and inflation? Hutchison, et al.(2012) did show that since the year 2000, due to increase in capital account openness there was an increase in exchange rate volatility, which in turn has led to higher inflation. At the same time, during the episodes of exchange rate stability the inflation turned out to be lower. But some studies argue that exchange rate stability did not have any impact on inflation as the prices in India are relatively lower when compared to trading partners1.

India has made a transition from relatively fixed exchange rate regime to an officially claimed managed float regime. Since then, the empirical studies show that the de facto regime indeed resulted in considerable stability in the foreign exchange market. While stability in the market can be ensured through many ways, stability in Indian market was largely due to central bank intervention in order to manage excess volatility. The literature on the optimal exchange rate regime favours a regime that ensures low inflation with better policy predictability. Further, existing studies suggest that a stable exchange rate is considered less inflationary than a more flexible regime as it has a restrictive impact on the determinants of inflation such as money supply and money demand.

Similar to advanced countries, India also experienced a ‘Great Moderation’ until 2007 with low inflation. Whether this low inflation regime is due to stability in the foreign exchange market is an empirical question, which Mohanty and

1. This point was highlighted in the recent World Bank’s International Comparison Program (ICP), April, 2014

|

Bhanumurthy (2014) try to attempt. Based on monthly data from April 1994 to June 2011, three regimes have been identified (April 1994 to May 1996; June 1996 to June 2008; and July 2008 to June 2011). Exchange rate volatility is found to be lower in the second regime that largely coincides with ‘Great Moderation’; while the third regime, which is the post-global financial crisis period, shows the highest volatility. However, the whole period shows a modest volatility, indicating that the de facto regime by and large resulted in stable exchange rate in India.

As discussed earlier, in India, exchange rate stability, particularly in the first regime, is significantly due to large interventions by the central bank to contain excess volatility. The trends in net foreign exchange assets show that higher intervention did reduce exchange rate volatility (negative correlation coefficient). Following impossible trinity, where independent monetary policy is feasible in a situation of free capital inflows and not so flexible exchange rate regime, the second round impact of higher net foreign assets due to intervention could be inflationary with higher money supply growth. However, this period has coincided with moderate inflation.

From the theory, there are two channels through which exchange rate stability can affect inflation: credibility effect through its impact on interest rates and the discipline effect working on money supply. Mohanty and Bhanumurthy (2014) show that it is not just the intervention, which ensured exchange rate stability in all the regimes, that resulted in low inflation. Rather it is the large sterilized intervention that has kept a check on reserve money growth and its inflationary consequences resulting from its attempt to maintain a stable exchange rate. The second regime (June 1996 to June 2008), which has seen substantial sterilized intervention following large capital inflows, experienced least exchange rate volatility and at the same time lowest growth in net foreign assets compared to the other two regimes. This also points to the loss of monetary policy autonomy owing to the ‘impossible trinity’ coming to play with steady increase of capital inflows.

The inflation targeting literature argues that stable inflation rates result in stable exchange rates. Our results suggest that low inflation does not ensure exchange rate stability. The de facto exchange rate regime with intervention is still valid for India. In the absence of sterilisation, whether the theoretical stable exchange rate-inflation relationship could hold is an empirical issue. One implication is that, contrary to the suggestion by the Urjit Patel Committee, India is not yet a candidate for inflation targeting regime. Rather the RBI needs to continue its policy of balancing between inflation, financial stability, and growth as part of its present multiple indicator approach.

References |