It is suggested that Indian investors have taken a liking to the Indian stock market1. As retail investors and individual traders enter the market regulators and experts worry about the implications of the trend. A significant aspect of this trend is the income profile of investors and their time horizon for investments. In this article, we observe the growth in stock market participation by size of incomes and relative to income tax returns to infer about the profile of the investors.

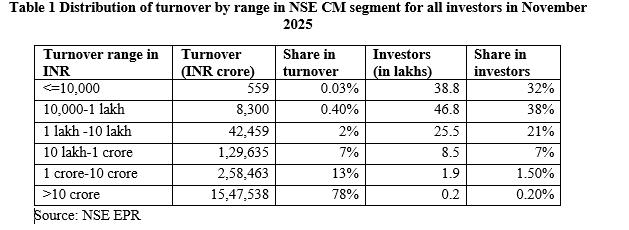

The number of active client accounts at CDSL and NSDL increased eight fold between 2015-16 and 2024-25. The NSE recorded a 3.4 times increase in unique investor accounts/client codes in the 4 years period between 2020 and 2024, that stood at 24.7 crore as of December 2025. Client codes are different from investors as each investor can have multiple client codes. Turning to unique investors, the NSE reports an increase in the number of unique PANs from 3.1 crore in FY20 to 12.3 crore in FY26. At the same time, NSE reports that while there has been an expansion in the turnover across the cash, options and futures market the turnover has been concentrated among a very small share of high value investors2. “In the equity cash segment, just 1.7% of investors—those trading above Rs 1 crore, accounted for more than 90% of turnover in November, while nearly 70% of investors contributed less than 1%.” In fact, in the capital markets segment the NSE, the turnover is concentrated in the largest range of more than 10 crores but with the smallest share in investors.

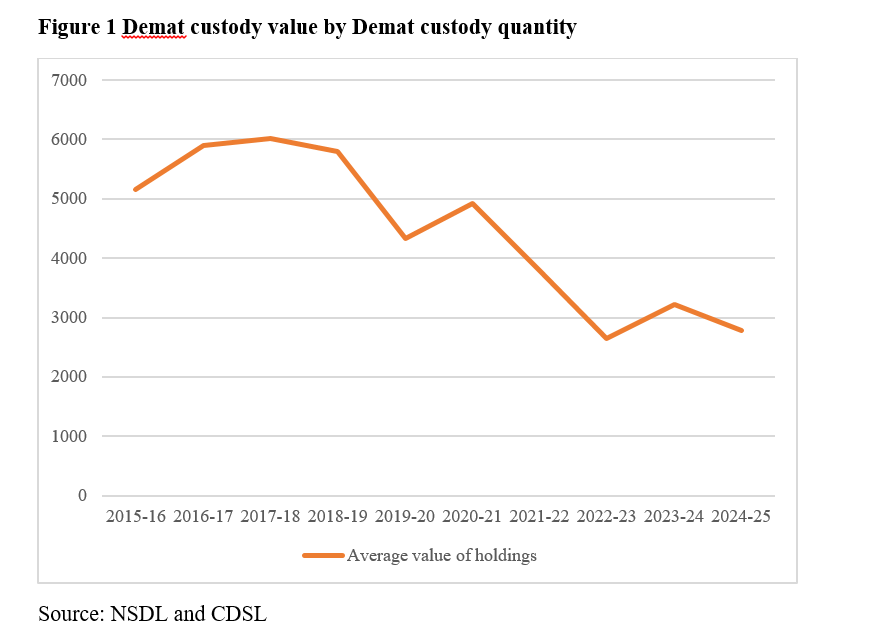

It is suggested that the individual small investors though a majority of the participants in the market contributed minimally to the turnover. This is reflected in the declining average value in custody per Demat account.(Figure 1) The systematic decline suggests either that there are an increasing number of accounts with nil value in custody or very small value in custody.

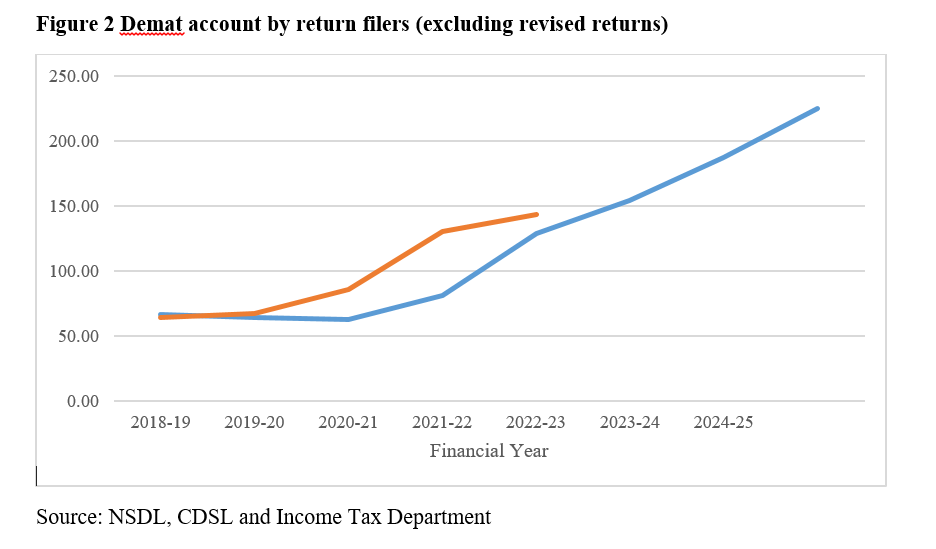

An alternative way to look at the emerging trends is to juxtapose demat accounts with returns filed (Figure 2). Market participants are taxed on their incomes based on the nature of trades, long term investments would be subject to capital gains. Short term sale and purchase are subject to short term capital gains and then frequent or speculative trading may be treated as business income. Thus we juxtapose the information on return filers and the returns where long term capital gains have been reported with the demat accounts. Since the long term capital gains on equity shares only became applicable after the financial year 2018-19, we take information for years after. It is observed that in the years after 2021-22 the number of accounts increased to more than 100% for return filers, overall and in the category of long term capital gains. Even considering the ratio of number of unique PAN numbers reported in NSE to number of returns filed, the ratio indicates an increase from 88 percent for 2021-22 to 113 percent in 2023-24 further to 140 percent in 2025-26. This suggests that expansion in accounts is at income levels not subject to tax.

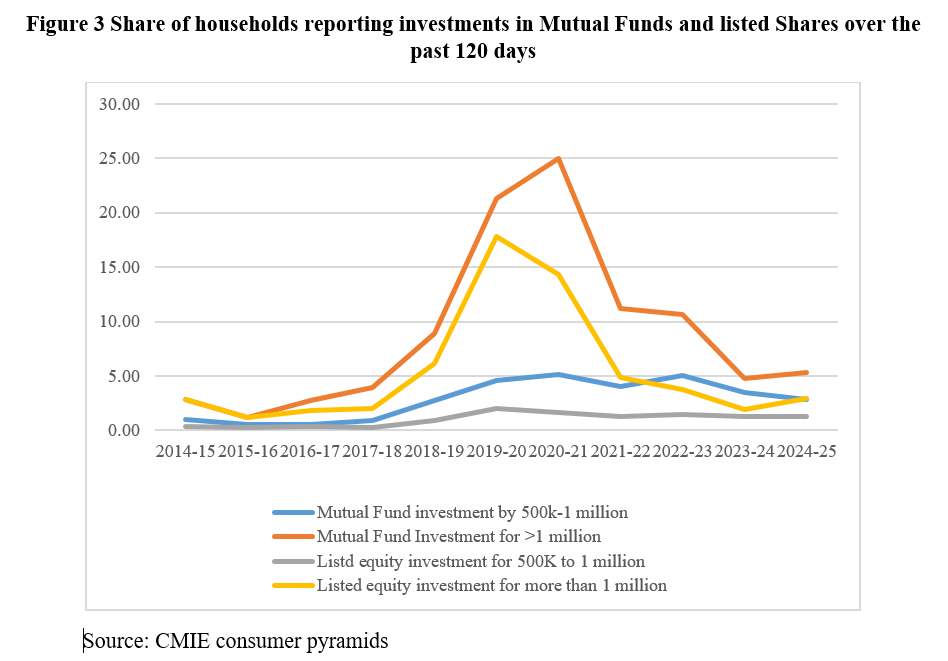

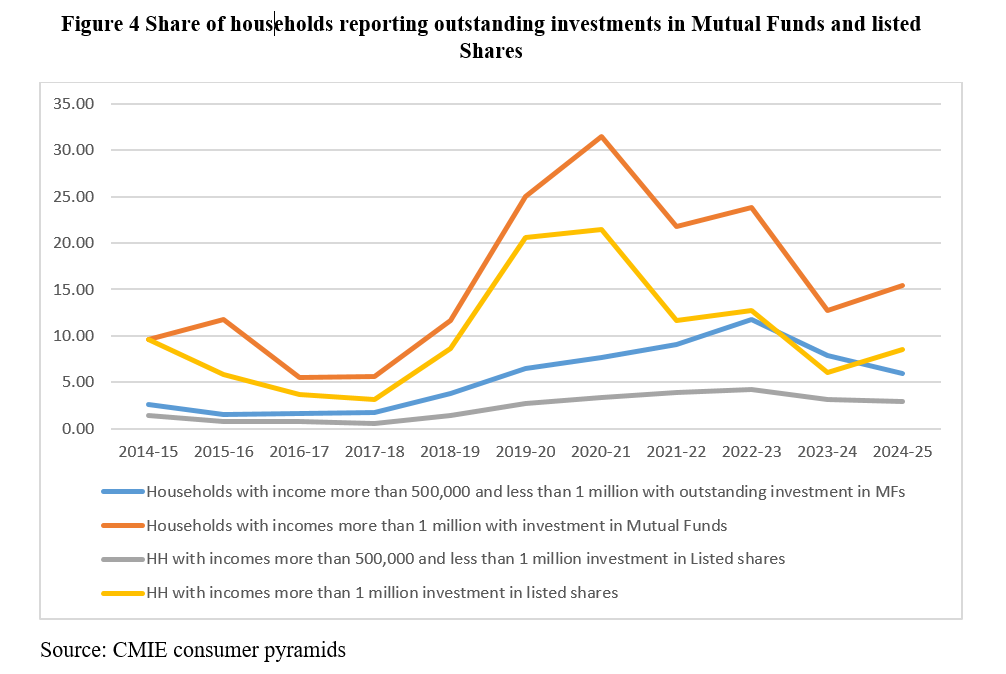

To understand the income profile of investors a little more, one can use the CMIE consumer pyramids data. The survey asks households if they invested in mutual funds and listed equity in the past 120 days and if they have outstanding investments in the aforementioned. The reported answers are reflected in Figures 3 and 4. From their sample it is observed that a significant share of households with incomes above Rs 5 lakh report investing in mutual funds and equity. The participation is higher in households with incomes above Rs 10 lakh. A surprising feature to note is the surge in participation in 2020 and 2021 followed by a sharp decline. For households with income between Rs 5 lakh and Rs 10 lakh, too there is a moderation in interest in 2023-24 and 2024-25. This holds for investments in mutual funds as well as listed shares. (Figure 3). Similar trends are observed for outstanding investments as well.

These trends seem to validate the idea that small investors remain a small part of the investor base for capital markets in India. The initial surge in interest seems to have moderated. Further, the composition of household savings suggests an increase in the share of mutual funds and equity, with the former occupying a larger role. For 2024-25, as per RBI data on household financial savings, the share of mutual funds has increased to 13 percent while that of equity is 2 percent. Given these choices of the households, household participation in equity markets cannot lend adequate depth to the markets to moderate the volatility emerging during to international shocks. In terms of scale, the opportunities and the risks still remain with the DIIs.

[1] India’s equity revolution: How domestic investors are reshaping markets | CFA Institute

[1]Page 228, https://nsearchives.nseindia.com//web/mediaattachment/2025-12/Market_Pulse_December_2025.pdf