As artificial intelligence reshapes global finance, central banks face a pivotal choice: integrate AI deeply into core monetary policy reaction functions or confine it to supportive operational roles? India's Reserve Bank (RBI) offers a compelling model with its Framework for Responsible Emerging AI in the Financial Sector (FREE-AI).

RBI’s FREE-AI crafted through extensive consultations with over 100 stakeholders—including banks, FinTechs, academics, and tech leaders—distils AI ethics into seven core "Sutras": safety, transparency, accountability, fairness, inclusivity, sustainability, and explainability. These principles underpin 26 recommendations across six pillars: governance, risk management, data stewardship, model lifecycle management, stakeholder engagement, and innovation enablement. This AI framework is principles-based and operationally actionable, providing regulated entities with practical tools like board-level oversight templates, bias audit protocols, and incident reporting mechanisms.

Crucially, RBI’s FREE-AI avoids entangling AI with the RBI's rules-based new monetary policy framework, particularly its flexible inflation-targeting regime. This restraint is not a limitation but a strength. While AI offers immense operational upsides, grafting it directly into monetary policy reaction functions—such as automated interest rate adjustments—would be perilous. AI doesn't just accelerate efficiencies; it unleashes an "AI-propagated supply shocks[i]." These disruptions ripple through pricing algorithms, labour markets, and expectations in real time, compressing the central bank's decision window from months to minutes. Traditional doctrines, where policymakers "look through" temporary supply shocks as beyond interest rate levers, falter here—as LSE (2025) notes, "Central banks have often ‘looked through’ supply shocks, assuming they are temporary and outside the reach of interest rate tools. But that doctrine is becoming harder to defend."

Backdrop: What the India’s Central Bank Does

Entities across the financial sector - from banks to fintechs - have been at the forefront of adopting advanced technology. Various developments over the last few decades, including increased computing power, faster processor speeds, lower hardware costs, and cloud services have accelerated this trend.[ii] AI is no exception. While the financial sector has long utilised AI tools, adoption has accelerated over the last years, especially since the proliferation of generative AI, in particular Large Language Models (LLMs).[iii] As AI tools and services have become widespread, jurisdictions have enacted policies and regulations to deal with their associated risks, which include, inter-alia, misinformation/bias, lack of transparency, and data privacy.[iv]

Currently, India does not have a unified regulatory framework for AI, akin to, say, the European Union’s (EU) AI Act (2024). Rather, various entities across the Indian government have taken up specific responsibilities. The NITI Aayog (a government think-tank) has set out high-level principles for safe AI usage across sectors.[v] The Ministry of Electronics and Information Technology (MeitY), on the other hand, has taken up an ‘operational’ mandate to offer datasets, AI models, and computing power to users under the ages of the ‘India AI Mission’.[vi] Against this backdrop, India’s central bank, the Reserve Bank of India (RBI) in December 2024, announced the constitution of a committee to examine how AI-usage in the financial sector could be regulated.[vii] Titled the ‘Framework for Responsible and Ethical Entablement of Artificial Intelligence’ (FREE-AI) committee, it was to comprise experts drawn from government, academia, and the private sector. The committee released its report in August 2025, after consulting a variety of stakeholders, including commercial banks, NBFCs (Non-Banking Financial Corporations), think-tanks, and technology/fintech firms.[viii]

At the core of the RBI Free-AI Framework lie seven guiding principles or ‘sutras’[ix], which are as follows[x]:

Maintaining trust in financial markets as a guiding principle

- People-first approach towards AI usage

- Emphasising responsible innovation over restraint

- Ensuring fair and non-discriminatory outcomes

- Accountability for entities deploying AI models

- Understandability by design in AI models to foster trust

- Safety, Resilience and Sustainability

To operationalise these principles, the FREE-AI is structured around six thematic pillars: Infrastructure (focusing on the data ecosystem), Policy (developing sector-specific guidance), Capacity (investing in skills and competence), Governance (establishing clear accountability on the part of deploying entities), Protection (ensuring consumer safeguards and bias mitigation), and Assurance (implementing independent audits and continuous monitoring).

The framework includes twenty-six actionable recommendations covering a variety of themes, including the establishment of AI innovation sandboxes, ‘indigenous’ domain-specific financial AI models, robust governance mechanisms, and incident reporting systems.

The Way Forward

To conclude, RBI’s FREE-AI is a credible, forward-looking framework that focuses specifically on the usage of AI by financial sector participants in India. The concurrent focus on AI innovation and mitigation of related risks constitutes a ‘middle ground’; balancing the innovation-first approach led by the United States of America (USA), and the more restrictive, safety-first approach followed by the EU. The way forward are fourfold.

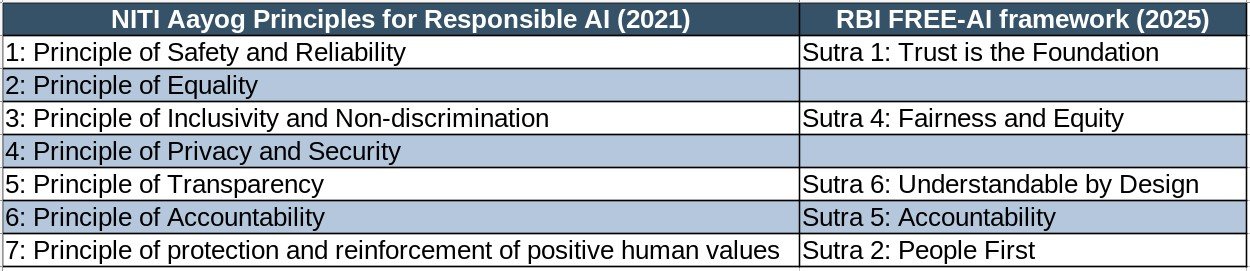

Cohesive AI framework: The FREE-AI recommendations are based on seven broad principles. Simultaneously, the NITI Aayog has articulated high-level principles for AI in India (Table 1). This calls for a more cohesive and congruent ecosystem of AI framework in India.

Table 1: Mapping the NITI Aayog’s Principles for Responsible AI (2021) with the FREE-AI framework (2025).

Low AI adoption by REs: The RBI conducted two surveys with its regulated entities (REs) to inform the FREE-AI report and recommendations.[i] The findings from these surveys are rather stark. Only 21 percent of surveyed entities utilised AI of any kind, with most entities using simple rule-based and non-learning[ii] models.[iii] Further, no Urban Cooperative Banks (UCBs) or Asset Reconstruction Companies (ARCs) utilise any AI tools at all. The report also notes that AI usage is concentrated within larger entities.

In order to ensure a more balanced adoption of AI, the FREE-AI committee should have provided tailored recommendations for the entities that the RBI regulates, including: various banks, NBFCs, and payment systems. Further, specific guidance for small entities - which often lack the resources to handle high compliance costs or invest heavily in AI systems - would have been welcome.

Institutional Framework: Some of the RBI recommendations provided in the FREE-AI framework place significant institutional role for RBI. Recommendation 8, for instance, suggests that the RBI set up a permanent, multi-stakeholder Standing Committee to monitor AI evolution and assess extant regulatory frameworks. Similarly, recommendation 11 posits that the RBI may set up a ‘dedicated AI institute’ to support capacity development in the financial sector. While placing RBI at the forefront, the Financial Stability and Development Council (FSDC) - comprising members from the Securities and Exchange Board of India (SEBI), Insurance and Regulatory Authority of India (IRDAI), and the Department of Financial Services (DFS), and MeitY can also be the part of AI institutional framework .[iv] The Ministry of Electronics and Information Technology (MeitY) will soon release its AI framework, against their October 22nd announcement for a mandatory disclosure and labelling of AI generated synthetic content to allow users to self-declare if the content they upload is AI-generated.

[i] Details are provided in Chapter 3 of the FREE-AI report.

[ii] That is, they do not use self-learning algorithms of the kind utilised in machine learning techniques.

[iii] It could be argued that such rule-based tools are not the focus of recent regulatory efforts on AI across the world; including the FREE-AI report itself.

[iv][iv] The FSDC is a cross-government, inter-regulatory forum that deals with issues relating to financial stability, financial sector development, inter–regulatory coordination, financial literacy, financial inclusion and macro prudential supervision. See this link for more details: https://www.pib.gov.in/newsite/PrintRelease.aspx?relid=95543

[i] https://blogs.lse.ac.uk/businessreview/2025/10/08/ai-is-changing-inflation-dynamics-and-challenging-central-banks/

[ii] Financial Stability Board (2017). Artificial intelligence and machine learning in financial services: https://www.fsb.org/uploads/P011117.pdf

[iii] Financial Stability Board (2024). The Financial Stability Implications of Artificial Intelligence: https://www.fsb.org/uploads/P14112024.pdf

[iv] For more details on the general risks associated with AI, refer to the MIT AI Risk Repository: https://airisk.mit.edu/

[v] NITI Aayog (2021). Approach Document for India - Principles for Responsible AI. https://www.niti.gov.in/sites/default/files/2021-02/Responsible-AI-22022021.pdf

[vi] https://indiaai.gov.in/. The AiKosh website provides access to datasets and models: https://aikosh.indiaai.gov.in/home

[vii] Reserve Bank of India (2024). Statement on Developmental and Regulatory Policies. https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=59245

[viii] Reserve Bank of India (2025). FREE-AI Committee Report. https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/FREEAIR130820250A24FF2D4578453F824C72ED9F5D5851.PDF

[ix] The term means ‘principles’ in Hindi/Sanskrit.

[x] Chapter 4, FREE-AI Report.

( The author gratefully acknowledges NIPFP Professor Dr Lekha Chakraborty’s valuable comments and guidance.)